Why bank FDs are a bad idea for long term wealth creation.

I've friends who prefer Bank FDs. But in the falling interest rate market like India, bank FDs make no sense.

Please read my other article on purpose of investment here:https://blog.talkingdev.com/blog/2020-06-19-the-true-purpose-of-investing-beating-the-inflation/

Let us discuss why Bank FDs are a bad idea looking at historical data.

Let's assume you invested 1,00,000 in 2014 for 5 year bank FD.

The interest rate for 5+ year FD was 8.5%, (It is even less now - 6.5%, so future yeild will be significantly less than this example).

With this rate and initial amount, on maturity you will be eligible to get Rs. 150,365.67. But hold on, Assuming you are in higher tax bracket, capital gain of Rs. 50,365.67 will be fully taxable based on your slab, 30%.

So the final amount you will get in hand will be close to Rs. 1,35,250 with bank fixed deposit.

Now let's say you had invested that amount in a Debt fund instead. A good debt mutual fund gives FD like returns usually.

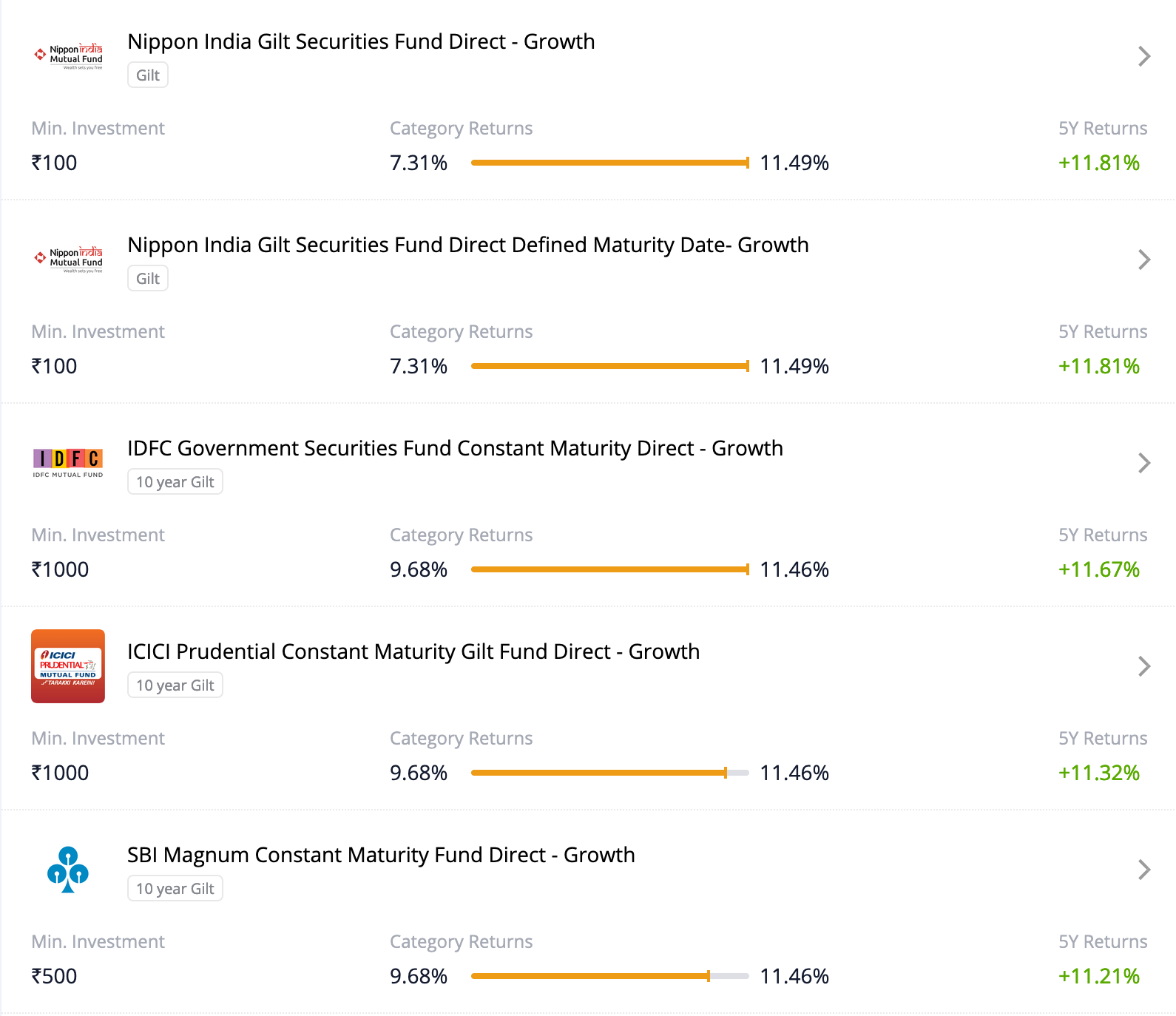

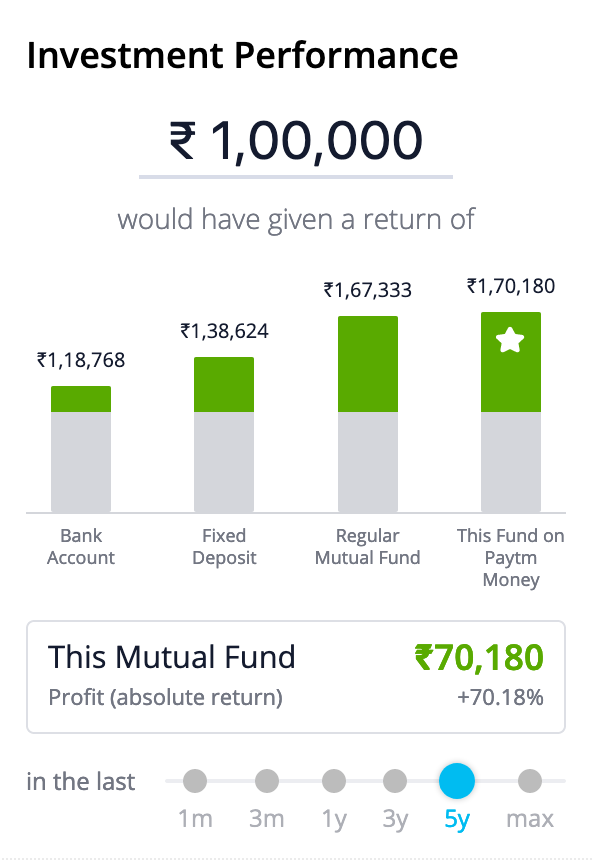

Take example of these 4 Debt mutual funds, which all gave 11%+ yearly compunding rate returns in past 5 years.

For example SBI Magnum Constant Maturity Fund Direct - Growth, would have returned 1,70,000 before tax. 20k+ higher than Bank FD.

For fairness, suppose you chose an under-performing fund which still gave an annual compounded return of 8.5%. By same calculation above, yield before tax is approx Rs. 1,50,000. But here comes the catch. Debt mutual funds enjoy indexation benefit.

You can read this great article on Groww to understand what it is: https://groww.in/blog/indexation-in-mutual-funds-meaningbenefits-and-more/

To summarize, indexation benefit takes into account the inflation rate over a period and reduces your tax liability.

Ministry of Finance notifies a Cost Inflation Index (CII) every year.

| Financial Year | CII Number |

| 2020-21 | 301 |

| 2019-20 | 289 |

| 2018-19 | 280 |

| 2017-18 | 272 |

| 2016-17 | 264 |

| 2015-16 | 254 |

| 2014-15 | 240 |

| 2013-14 | 220 |

| 2012-13 | 200 |

The formula to calculate inflation-adjusted cost price is: (CII of the year of sale/CII for the year of purchase) * Actual cost price

Considering 2014 as purchase year and 2019 as sale year for Debt mutual fund units. Inflation adjusted purchase price is

(289/240)*1,00,000 = 1,20,416.66 (Rounding that off to 1,20,000 for future caluclations).

Now we calculate actual inflation adjusted capital gains which is, (yield - inflation adjusted purchase price) ->

1,50,000 - 1,20,000 = Rs 30,000

You will be required to pay tax on 30 thousand rupees as oppose to 50 thousand on bank FD.

But here comes another bonus, LTCG tax (Long Term Capital Gains tax) on debt mutual funds held for 3+ years is about 20% (10% surcharge and 4% education cess extra, so about 23% ). You do not pay based on your slab.

Actual paid tax is : 30,000 - (23% * 30,000) = 6900.

Now the final in-hand amount becomes 1,50,000 - 6900 = Rs 1,43,100.

With our example of 8.5% yearly compunding rate for both fixed desposit and debt mutual fund:

Bank FD: Rs. 1,35,250.

Debt Mutual Fund: Rs. 1,43,100.

Now always keep in mind that current fixed depsit rate is only 6.5% currently and may fall or increase slightly.

Another disadvantage of Bank FD is the lower interest rate and penalty on premateur withdrawel. In case of Debt mutual funds, after 1 year there's usually no exit load but you don't get any indexation benefit if Debt MD units were held for less than 3 years.

Bank FDs still makes sense in following scenerios:

I personally believe that for long term investments (3-7 years), Debt Mutual Funds are far superior than Bank FDs. If your investment horizon is 8+ years, equity and equity mutual funds are better, but that's a topic for another future article.

You can provide feedback to this post by writing an email to : talkingdevblog+investment@gmail.com or find me on twitter @QM_Ashwin